Fica withholding calculator

And so if youre. Employers remit withholding tax on an employees behalf.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

You can use the Tax Withholding.

. Urgent energy conservation needed. These tax calculations assume that you have all earnings from a single employer. IR-2019-155 September 13 2019.

For help with your withholding you may use the Tax Withholding Estimator. Add 500 75 for a total of 575 in gross wages for the week. WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov.

Federal income tax and FICA tax. Ad Track Your Miles Fuel by State and Make Your IFTA Filing Easier. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

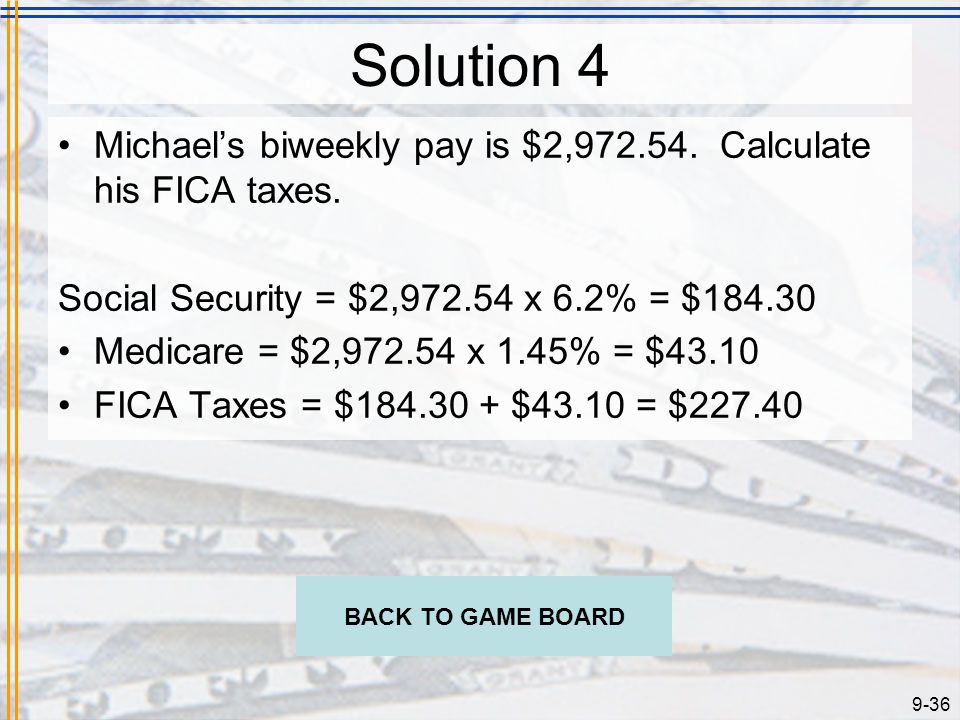

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. Our free online FICA Tax Calculator is a super easy tool that makes it easy to calculate FICA tax for both those who are an employee and those who are self employed. This calculator is a tool to estimate how much federal income tax will be withheld.

See how FICA tax works in 2022. Free step-by-step webinar September 19. 2 or 62 would be applied against the employers payroll tax for that cycle.

Determine the amount of pay. 2022 Federal Tax Withholding Calculator. How It Works.

See how your refund take-home pay or tax due are affected by withholding amount. It is possible to have been overwithheld for OASDI FICA taxes in the event that the. Estimate your federal income tax withholding.

What the previous paragraph shows is that being self-employed is like being an employee but at a lower salary - lower by the FICA half that employers pay for their employees. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

If you need more information about tax withholding read IRS Publication 554 Tax Guide for Seniors and Publication 915 Social Security and Equivalent Railroad Retirement Benefits. 2 or 62 would be deducted from the employees gross earnings and would be filed with the IRS. Then multiply four overtime hours x 1875 15 times the hourly rate 7500.

Use this tool to. Get the Latest Federal Tax Developments. For example if an employees taxable wages are 700.

How Your Paycheck Works. This is a projection based on information you provide. To calculate FICA tax contribution for an employee multiply their gross pay by the Social Security and Medicare tax rates.

The Federal Insurance Contributions Act FICA is a federal law that requires employers to withhold three different types of employment taxes from their employees. The information you give your employer on Form W4. Raise your AC to 78 from 3pm - 10pm.

Get the Latest Federal Tax Developments.

Fica Taxes For Employee Youtube

Federal Tax Calculator Factory Sale 53 Off Www Wtashows Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

Federal Income Tax Calculator Flash Sales 57 Off Www Wtashows Com

Tax Calculator 2020 Discount 57 Off Www Wtashows Com

Chapter 9 Payroll Mcgraw Hill Irwin Ppt Download

Chapter 9 Taxes Start Exit Ppt Download

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Calculate Federal Withholding Tax Youtube

Enerpize The Ultimate Cheat Sheet On Payroll

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

How To Calculate Federal Income Tax

What Is Fica Tax Contribution Rates Examples

Federal Income Tax Rate Calculator Factory Sale 53 Off Www Wtashows Com

Question 3 The Social Security Or Fica Tax Has Two Chegg Com